Checklist for your first international trade contract

Fear of mistakes or delays in settlements is one of the main reasons that stops entrepreneurs from taking active steps. Incorrect paperwork, the wrong choice of bank or payment method can lead to fines, transaction blocks and lengthy time losses. This creates additional stress and makes one doubt their abilities.

However, any risks can be minimized with proper preparation and timely support. Professional assistance and a clear action plan play an important role here. At Khlynov Bank we understand your concerns and help you go through the key stages of a foreign trade transaction as safely, quickly and transparently as possible.

We have prepared a short checklist that will help you take into account all the important points when concluding your first foreign trade contract, confidently and without unnecessary worries.

1. Determine the payment terms and currency of settlement

Agree with your counterparty on the form of payment (prepayment, letter of credit, deferred payment) and choose the settlement currency. This stage is crucial, as it determines the payment route and the amount of fees. We recommend agreeing in advance with your partner on the possibility of settling through third parties.

2. Choose the bank to carry out the settlements

A foreign currency account is required to make settlements in foreign currency with overseas counterparties. If the partner is willing to work in rubles, a regular current account is sufficient.

Important: transactions with foreign partners in rubles are also subject to currency controls.

At Khlynov Bank you can open accounts in Russian rubles and in 11 of the most in-demand foreign currencies: Chinese yuan, Kazakhstani tenge, Turkish lira, Indian rupee, Armenian dram, Kyrgyz som, Belarusian ruble, Serbian dinar, Lao kip, Brazilian real and Thai baht.

It is recommended to consider alternative payment options.

3. Prepare the package of documents for making the payment

Before conducting a foreign currency operation, you must submit documents to the bank to determine the optimal payment route and to verify the contract’s compliance with foreign exchange legislation, and, if necessary, to register the contract. Later you will need to report to the bank to confirm the fulfillment of obligations under the contract with the foreign partner: provide acceptance certificates, transport and customs documents, as well as a certificate regarding the supporting documents — the exact list depends on the type of transaction, the amount and the payment terms. A dedicated expert from Khlynov Bank will provide qualified support at all stages of document preparation. They will explain the process in detail, answer questions and help correctly complete all required forms to avoid mistakes.

4. Execute the payments under the transaction

After preparation is complete, proceed to settlements. Monitor the deadlines for performance by the foreign partner and do not forget to report the transaction to the bank.

By following this checklist, you will be able to properly prepare for a foreign trade transaction and avoid unnecessary risks. And to make the process as simple as possible and to ensure you have no doubts about the correctness of the settlements, Khlynov Bank assigns a personal foreign exchange expert to each client. Regardless of the scale of your business and the volume of operations, the specialist will help choose the optimal scheme, check the documents and carry out foreign currency operations in full compliance with legal requirements.

If you want to engage in foreign trade, submit an online application to open a foreign currency account and we will help organize settlements with foreign counterparties.

Другие Новости Кирова (НЗК)

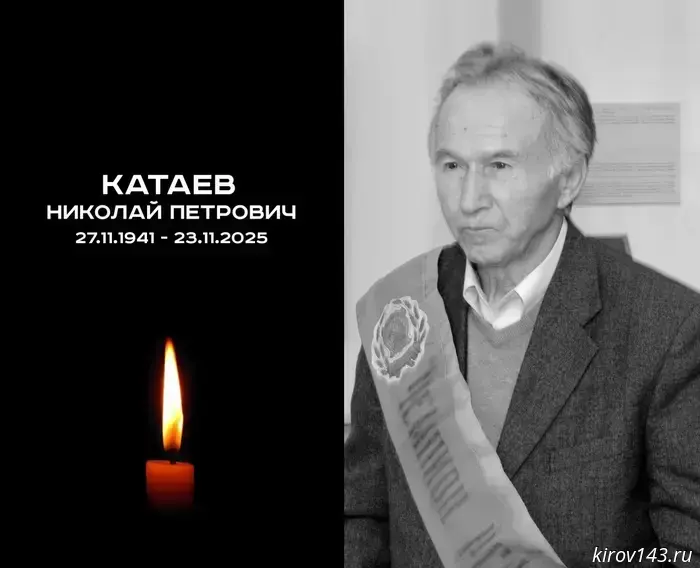

Former HC Olimpiya defenseman Nikolai Kataev has died.

He passed away at the age of 84.

Former HC Olimpiya defenseman Nikolai Kataev has died.

He passed away at the age of 84.

Belykh will "pull a stunt" with a pony for Kirov children

Former Kirov Oblast governor Nikita Belykh announced another New Year's charity drive. He is preparing sweet gifts in advance for children who are especially in need of a New Year's miracle.

Belykh will "pull a stunt" with a pony for Kirov children

Former Kirov Oblast governor Nikita Belykh announced another New Year's charity drive. He is preparing sweet gifts in advance for children who are especially in need of a New Year's miracle.

In Kirov, a 19-year-old drug addict who abandoned her 3-month-old son was caught.

Transport police officers found a 19-year-old woman showing signs of drug intoxication on the railway infrastructure in Kirov. At the time of her detention, her three-month-old infant was left unattended with strangers.

In Kirov, a 19-year-old drug addict who abandoned her 3-month-old son was caught.

Transport police officers found a 19-year-old woman showing signs of drug intoxication on the railway infrastructure in Kirov. At the time of her detention, her three-month-old infant was left unattended with strangers.

A Kirov company lost a lawsuit to Norvik Bank.

The company failed to prove that the charges under the loan agreement were made incorrectly.

A Kirov company lost a lawsuit to Norvik Bank.

The company failed to prove that the charges under the loan agreement were made incorrectly.

A plot near the Staromakaryevskoye Cemetery will be leased for the construction of a shopping center.

The cost of concluding the contract is more than 8.19 million rubles.

A plot near the Staromakaryevskoye Cemetery will be leased for the construction of a shopping center.

The cost of concluding the contract is more than 8.19 million rubles.

24 November 2025, 12:26

Society: The All-Russia People's Front initiated a large-scale survey in which residents of Nizhny Novgorod are invited to express their opinion on the results of the implementation of national projects and their impact on everyday life. You can take part in the study by following the link https://nk.onf.ru/surveys/NP_2025.

The survey covers the key areas in which the national projects are being implemented: healthcare, education, culture, housing and utilities, ecology, digitalization and others. Participants are asked to assess the current state of these areas, note positive or negative changes, and also name specific measures that have affected quality of life.

Particular attention is being paid to issues such as housing affordability, drinking water quality, the level of digital services in government bodies, and the amount of utility charges.

The study is conducted anonymously, and the collected data will be processed exclusively in aggregated form for the preparation of analytical reports.

As the organizers emphasize, the results of such surveys regularly form the basis of reports to the President of the Russian Federation. Based on them, the head of state issues directives to the relevant ministries and agencies, which directly influences the further development of the national projects.

Earlier it was reported that the Nizhny Novgorod Region entered the top 10 participants in the national project "Personnel."

NIA "Nizhny Novgorod" has a Telegram channel. Subscribe to stay informed about major events, exclusive materials and up-to-date information.

Copyright © 1999–2025 NIA "Nizhny Novgorod". When reprinting, a hyperlink to NIA "Nizhny Novgorod" is required. This resource may contain 18+ materials.

Since the start of active snow removal in Kirov, energy workers have noted cases of manhole covers being displaced and are urging residents to promptly report such dangerous situations.

24 November 2025, 12:26

Society: The All-Russia People's Front initiated a large-scale survey in which residents of Nizhny Novgorod are invited to express their opinion on the results of the implementation of national projects and their impact on everyday life. You can take part in the study by following the link https://nk.onf.ru/surveys/NP_2025.

The survey covers the key areas in which the national projects are being implemented: healthcare, education, culture, housing and utilities, ecology, digitalization and others. Participants are asked to assess the current state of these areas, note positive or negative changes, and also name specific measures that have affected quality of life.

Particular attention is being paid to issues such as housing affordability, drinking water quality, the level of digital services in government bodies, and the amount of utility charges.

The study is conducted anonymously, and the collected data will be processed exclusively in aggregated form for the preparation of analytical reports.

As the organizers emphasize, the results of such surveys regularly form the basis of reports to the President of the Russian Federation. Based on them, the head of state issues directives to the relevant ministries and agencies, which directly influences the further development of the national projects.

Earlier it was reported that the Nizhny Novgorod Region entered the top 10 participants in the national project "Personnel."

NIA "Nizhny Novgorod" has a Telegram channel. Subscribe to stay informed about major events, exclusive materials and up-to-date information.

Copyright © 1999–2025 NIA "Nizhny Novgorod". When reprinting, a hyperlink to NIA "Nizhny Novgorod" is required. This resource may contain 18+ materials.

Since the start of active snow removal in Kirov, energy workers have noted cases of manhole covers being displaced and are urging residents to promptly report such dangerous situations.

Checklist for your first international trade contract

The start of foreign economic activity and entry into the international market is an important and at the same time complex stage in business development. Many entrepreneurs face a multitude of questions and concerns related to unfamiliar processes: how to properly arrange payments, what they need to know about currency control, and which documents will be required for customs clearance.