The State Duma adopted a bill in its first reading to raise VAT to 22%.

The State Duma adopted in the first reading a bill to amend the Tax Code. The document provides for an increase in the value-added tax from 20 to 22% starting in 2026.

For socially significant goods the tax rate will remain at the preferential level of 10%. Such goods include bread, dairy products, meat, butter, sugar, as well as certain vegetables and fruits.

According to estimates, the VAT increase will allow federal budget revenues to rise by 1.18 trillion rubles in 2026, by 1.55 trillion in 2027, and by 1.67 trillion rubles in 2028. This is reported by kommersant.ru.

In addition, the document proposes to change the conditions for applying the simplified taxation system. The maximum annual revenue threshold for entrepreneurs is planned to be reduced from 60 to 10 million rubles. This measure, according to the explanatory note, will bring the federal budget an additional approximately 200 billion rubles.

Другие Новости Кирова (НЗК)

Offline navigator for drivers: trips without internet interruptions

Drivers now have access to an offline navigator that allows them to plan routes even with an unstable network connection. The new tool helps preserve earnings and avoid interrupting trips when the connection drops en route.

Offline navigator for drivers: trips without internet interruptions

Drivers now have access to an offline navigator that allows them to plan routes even with an unstable network connection. The new tool helps preserve earnings and avoid interrupting trips when the connection drops en route.

They won't agree with Taureans, and Scorpios will be nervous.

They won't agree with Taureans, and Scorpios will be nervous.

They won't agree with Taureans, and Scorpios will be nervous.

They won't agree with Taureans, and Scorpios will be nervous.

The regional operator presented the results of nine months' work.

The regional operator explained how it is fostering an environmental culture.

The regional operator presented the results of nine months' work.

The regional operator explained how it is fostering an environmental culture.

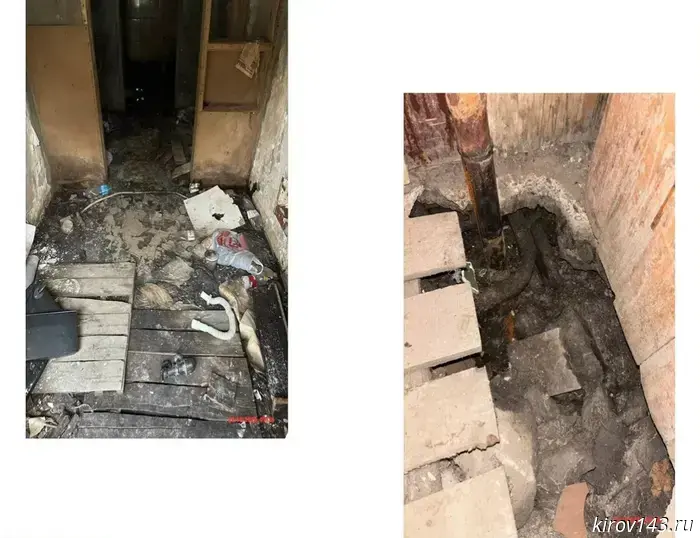

In Kirov, a criminal case was opened after an inspection of a building on Herzen Street.

The State Housing Inspectorate identified violations in the operation of the drainage system.

In Kirov, a criminal case was opened after an inspection of a building on Herzen Street.

The State Housing Inspectorate identified violations in the operation of the drainage system.

The Legislative Assembly supported providing free legal assistance to Kirov residents deprived of parental rights.

The deputies passed the bill in two readings.

The Legislative Assembly supported providing free legal assistance to Kirov residents deprived of parental rights.

The deputies passed the bill in two readings.

The number of deputies in Kirov Oblast will increase.

The Legislative Assembly considered a bill introducing amendments to the Charter of Kirov Oblast.

The number of deputies in Kirov Oblast will increase.

The Legislative Assembly considered a bill introducing amendments to the Charter of Kirov Oblast.

The State Duma adopted a bill in its first reading to raise VAT to 22%.

The document provides for an increase in the tax rate and changes to business conditions.