The Central Bank proposes to limit the number of bank cards to combat fraud

The Central Bank proposed to introduce restrictions on the number of bank cards issued per person. This measure is aimed at combating so—called intermediary drops that help fraudsters withdraw and cash out stolen money. The regulator believes that ordinary citizens do not open hundreds or thousands of cards, so the restrictions will not affect bona fide users.

As additional measures to combat cyberbullying, the introduction of criminal liability for "drops" is being discussed. The Central Bank also proposes to oblige parents of teenagers under the age of 18 to consent to the opening of accounts and receipt of bank cards by their children in order to monitor financial transactions and identify suspicious activities in time.

In addition, the Central Bank proposes to introduce a "cooling-off period" for loans so that citizens can come to their senses and refuse a loan issued under the influence of fraudsters. Banks will have to write off citizens' debts on loans issued in violation of anti-fraud procedures.

In the future, the Central Bank intends to increase the responsibility of banks and telecom operators for the safety of customer funds. The regulator proposes to combine the efforts of banks and operators to identify and block fraudulent calls. The Bank of Russia is ready to act as a "single window" for the exchange of fraud data between banks.

Другие Новости Кирова (НЗК)

Tunnel under the Transsib will change the traffic pattern in Novovyatsk

A grandiose project to build a long-awaited tunnel under the Trans-Siberian Railway in the Novovyatsky district of Kirov is entering an active phase. Residents should prepare for changes in traffic patterns and difficulties.

Tunnel under the Transsib will change the traffic pattern in Novovyatsk

A grandiose project to build a long-awaited tunnel under the Trans-Siberian Railway in the Novovyatsky district of Kirov is entering an active phase. Residents should prepare for changes in traffic patterns and difficulties.

More than 6 thousand families received a payment for the birth of a child in a year

In the Kirov region, in 2024, 6003 families received a one-time allowance for the birth of a child.

More than 6 thousand families received a payment for the birth of a child in a year

In the Kirov region, in 2024, 6003 families received a one-time allowance for the birth of a child.

Kirov residents named the most coveted gifts for March 8th

Kirov residents participated in a survey from the job search service SuperJob and named what they would like to receive as a gift on March 8.

Kirov residents named the most coveted gifts for March 8th

Kirov residents participated in a survey from the job search service SuperJob and named what they would like to receive as a gift on March 8.

Kirov discusses protection of youth from negative phenomena

A two-day interregional forum "League of Prevention" (18+), dedicated to countering negative social phenomena among young people, has begun its work at the Vyatka State University Engineering.

Kirov discusses protection of youth from negative phenomena

A two-day interregional forum "League of Prevention" (18+), dedicated to countering negative social phenomena among young people, has begun its work at the Vyatka State University Engineering.

"Black lumberjack" paid more than half a million rubles for illegal logging of trees

The court ordered an individual entrepreneur from the Nolinsky district to pay damages from the crime.

"Black lumberjack" paid more than half a million rubles for illegal logging of trees

The court ordered an individual entrepreneur from the Nolinsky district to pay damages from the crime.

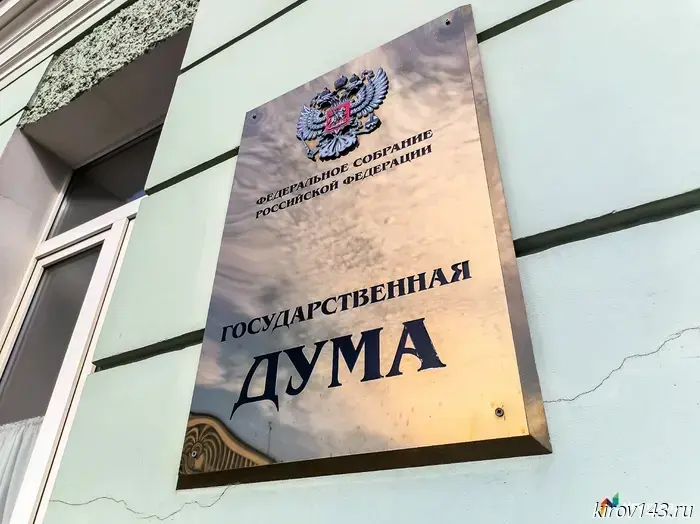

The State Duma adopted amendments tightening the legislation on foreign agents

State Duma deputy Maria Butina spoke about fines for foreign agents.

The State Duma adopted amendments tightening the legislation on foreign agents

State Duma deputy Maria Butina spoke about fines for foreign agents.

The Central Bank proposes to limit the number of bank cards to combat fraud

The Central Bank of Russia proposes to introduce restrictions on the number of bank cards issued per person.