The privatization placement of bank DOM.RF raised more than 25 billion rubles.

The offering of this bank’s shares became the first privatization placement in Russia since 2020. Market participants believe that the completion of this deal may set a precedent for other issuers under the privatization program.

It was noted that the placement was carried out in accordance with market standards, aided by the credit institution’s managerial and corporate practices. The offering demonstrated significant investor demand: the total amount raised exceeded 25 billion rubles.

Also, according to volga.news, retail investor activity was recorded — approximately 18 billion rubles worth of orders were submitted through one of the investment platforms. As part of this deal, the domestic market saw, for the first time, the practice of publicly disclosing anchor investors, which had previously been used only in international offerings. At the time of the transaction, this placement was the largest IPO of a Russian company since 2021, the largest banking IPO in Russia in the past 12 years, and one of the largest bank placements in Europe this year.

Другие Новости Кирова (НЗК)

In Kirov, the aftermath of a strong wind is being dealt with.

Specialists are restoring lighting on key streets.

In Kirov, the aftermath of a strong wind is being dealt with.

Specialists are restoring lighting on key streets.

The State Duma passed a law introducing a technological fee on electronic products.

The State Duma adopted in the third and final reading a law introducing, as of September 1, 2026, a technological levy on the import and production of products with an electronic component base.

The State Duma passed a law introducing a technological fee on electronic products.

The State Duma adopted in the third and final reading a law introducing, as of September 1, 2026, a technological levy on the import and production of products with an electronic component base.

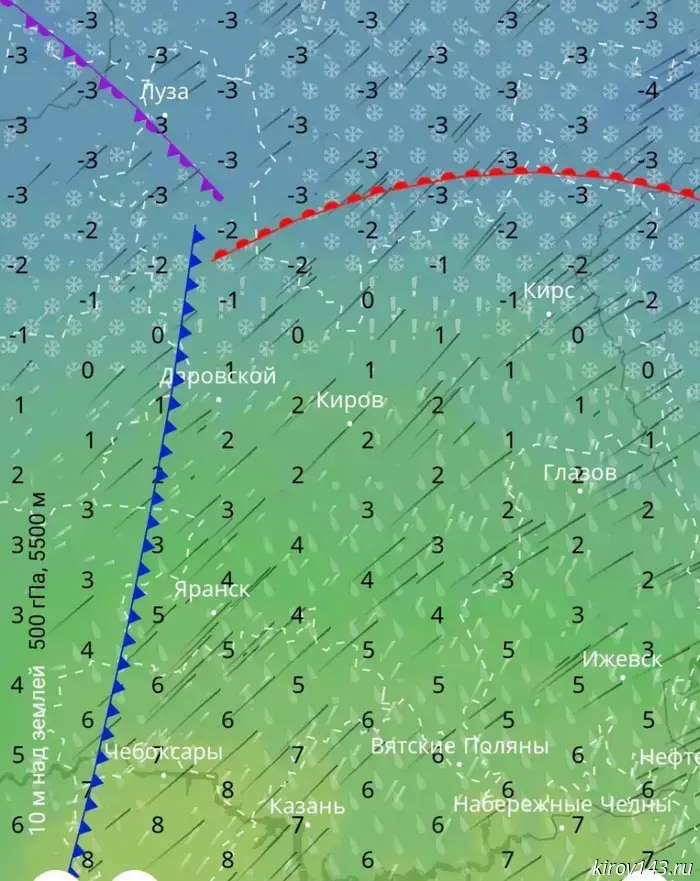

A short-lived November thaw is coming to Kirov Oblast.

According to the Telegram channel "Amateur Meteorology in Kirov", a warm air mass will once again sweep into the region on November 24 and 25.

A short-lived November thaw is coming to Kirov Oblast.

According to the Telegram channel "Amateur Meteorology in Kirov", a warm air mass will once again sweep into the region on November 24 and 25.

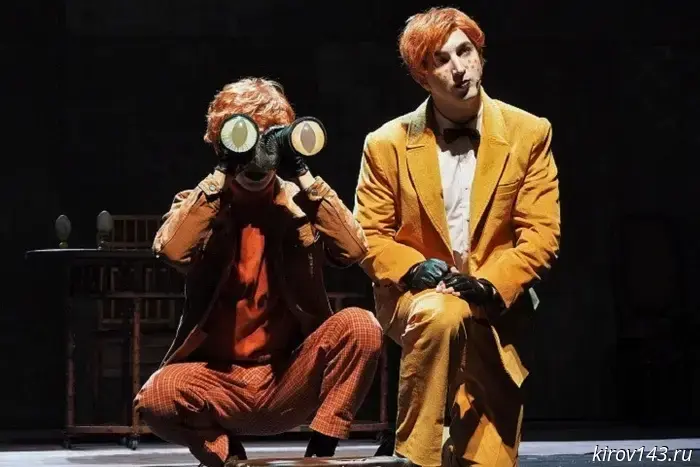

Two Kirov productions have been nominated for the Golden Mask for the first time.

Two theaters from Kirov were included in the list of nominees for the Russian National Theatre Award "Golden Mask" for the XXXII competition cycle (2024–2025), which was published on November 20, the government of Kirov Oblast reported.

Two Kirov productions have been nominated for the Golden Mask for the first time.

Two theaters from Kirov were included in the list of nominees for the Russian National Theatre Award "Golden Mask" for the XXXII competition cycle (2024–2025), which was published on November 20, the government of Kirov Oblast reported.

In Russia, they want to reduce insurance rates for most types of transportation.

The Bank of Russia announced a new initiative.

In Russia, they want to reduce insurance rates for most types of transportation.

The Bank of Russia announced a new initiative.

Sagittarians may be eaten alive by their conscience, and Aquarians need to sit down and think.

Astrologers published the stars' advice for each zodiac sign for the last working day of the current week.

Sagittarians may be eaten alive by their conscience, and Aquarians need to sit down and think.

Astrologers published the stars' advice for each zodiac sign for the last working day of the current week.

The privatization placement of bank DOM.RF raised more than 25 billion rubles.

A new practice has been introduced in Russian IPOs: disclosure of anchor investors.