The new reality of international trade: how the landscape of cross-border payments is changing

Recently there has also been a certain easing of compliance controls by foreign banks. It has become more lenient toward transactions where the recipient is the manufacturer of the goods in the destination country and the payment itself is directly linked to the delivery of the products. As a result, some companies have been able to return from agency schemes to direct payments. For example, after payments in Turkish lira were resumed in July, a client of Khlynov Bank was able to stop using intermediaries and began paying the counterparty for goods directly. Although the client's goods were dual‑use, the Turkish bank's compliance checks were passed without any problems.

"To reduce costs and increase the efficiency of international contracts, we recommend that companies conduct a preliminary review of available payment routes. I would note that selecting the optimal option precisely requires a full package of transaction documents. In practice, consultations with the bank's specialists often help companies negotiate with foreign partners to switch to more advantageous and secure payment channels," advised Svetlana Voronova, Head of Foreign Exchange Operations at Khlynov Bank.

Another important trend is the increase in the number of countries willing to settle transactions in their national currencies. In July Khlynov Bank established direct payments to Serbia, Brazil, Laos and Thailand, which significantly expanded the range of options for clients engaged in foreign economic activity.

Khlynov Bank is actively developing its international payment capabilities and continues to expand its infrastructure to support businesses with up‑to‑date solutions amid changing external market conditions.

You can review all service details, study the full terms, and open a foreign‑currency account with Khlynov Bank via the link.

Другие Новости Кирова (НЗК)

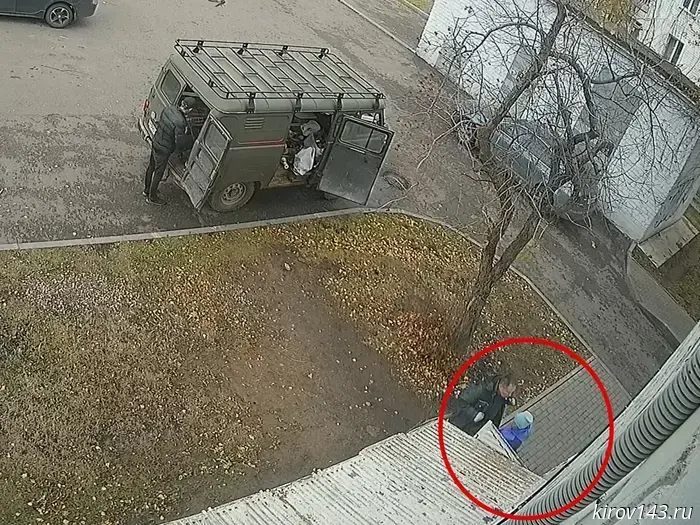

Chepurnykh remains unidentified to this day.

For almost two years the Kirov police "have been unable to identify" former judge Marat Chepurnykh, who is shown on video beating Kirov resident Nina Morozova.

Chepurnykh remains unidentified to this day.

For almost two years the Kirov police "have been unable to identify" former judge Marat Chepurnykh, who is shown on video beating Kirov resident Nina Morozova.

Igor Ronzhin, beaten in August, is undergoing treatment; the investigation into the assassination attempt continues.

Igor Ronzhin, a member of the Kirov Oblast Election Commission with an advisory vote representing the Communist Party (KPRF) and an assistant to Legislative Assembly deputy Sergey Mamaev, continues to receive treatment after a brutal attack in August in the town of Sosnovka, Vyatskopolyansky District.

Taureans should remain silent, and Libras will be dangerous.

Astrologers have revealed how the last working day of this week will go for each zodiac sign.

"Saving a patient is a collective effort": an intensive care physician talked about her work

A physician at the Center for Traumatology, Orthopedics and Neurosurgery shared how the work of anesthesiologist–intensivists has changed over the past 30 years and why one can never get used to patients' pain.

Igor Ronzhin, beaten in August, is undergoing treatment; the investigation into the assassination attempt continues.

Igor Ronzhin, a member of the Kirov Oblast Election Commission with an advisory vote representing the Communist Party (KPRF) and an assistant to Legislative Assembly deputy Sergey Mamaev, continues to receive treatment after a brutal attack in August in the town of Sosnovka, Vyatskopolyansky District.

Taureans should remain silent, and Libras will be dangerous.

Astrologers have revealed how the last working day of this week will go for each zodiac sign.

"Saving a patient is a collective effort": an intensive care physician talked about her work

A physician at the Center for Traumatology, Orthopedics and Neurosurgery shared how the work of anesthesiologist–intensivists has changed over the past 30 years and why one can never get used to patients' pain.

The new reality of international trade: how the landscape of cross-border payments is changing

In the first half of 2025, Khlynov Bank's payment network tripled. This growth indicates a positive trend: an increasing number of foreign financial institutions willing to cooperate with Russian companies. The practice of working with small Chinese banks remains particularly resilient, as they continue to process payments from Russian businesses without interruption.