A State Duma deputy reminded the public about the taxes that must be paid in October.

According to him, already at the beginning of the month employers must report personal income tax (NDFL): by October 3 they must send notifications of the calculated tax, and by October 5 — transfer the withheld amounts to the budget, the Public News Service reports.

The main burden, the deputy said, falls at the end of the month. By October 27 organizations are required to submit the VAT return for the third quarter, the profit tax return for nine months, Form 6‑NDFL and the calculation of social insurance contributions.

On October 28 companies transfer the first third of VAT and other mandatory payments through the unified tax account. “This date becomes the most intense financially — effectively the tax peak of the month,” Govyrin noted.

The self-employed must also pay the professional income tax for September by October 28. Individual entrepreneurs using the patent system should remember the patent payment deadlines: one third of the amount must be paid within 90 days from its start date.

According to the deputy, October turns into a real “tax marathon,” when the obligations of companies, the self-employed and individual entrepreneurs converge at the end of the month.

Другие Новости Кирова (НЗК)

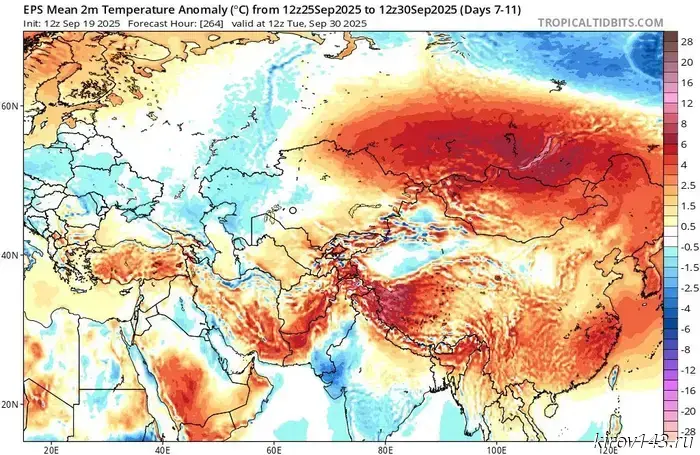

In Kirov Oblast, the first snowfalls may occur by the end of September.

The "Amateur Meteorology in Kirov" community warns that the first snow may fall in the region at the end of September.

In Kirov Oblast, the first snowfalls may occur by the end of September.

The "Amateur Meteorology in Kirov" community warns that the first snow may fall in the region at the end of September.

In Omutninsk, a case of the torture of a woman and a teenager is being investigated.

A criminal case has been opened in Omutninsk against a 36-year-old local resident suspected of torturing his wife and daughter. This was reported by the Investigative Department of the Investigative Committee of Russia for Kirov Oblast.

In Omutninsk, a case of the torture of a woman and a teenager is being investigated.

A criminal case has been opened in Omutninsk against a 36-year-old local resident suspected of torturing his wife and daughter. This was reported by the Investigative Department of the Investigative Committee of Russia for Kirov Oblast.

It's time for Aries to pursue their dream, and for Leos to wait for changes.

Astrologers revealed how each zodiac sign will spend Sunday.

It's time for Aries to pursue their dream, and for Leos to wait for changes.

Astrologers revealed how each zodiac sign will spend Sunday.

Russia led imports of Chinese passenger cars.

In August 2025, Russia increased imports of passenger cars from China to a year-to-date high and once again became their main buyer.

Russia led imports of Chinese passenger cars.

In August 2025, Russia increased imports of passenger cars from China to a year-to-date high and once again became their main buyer.

A State Duma deputy reminded the public about the taxes that must be paid in October.

In October 2025, Russians and companies will face a busy schedule of tax payments and reporting, said Alexey Govyrin (United Russia), a member of the State Duma committee on small and medium-sized businesses.