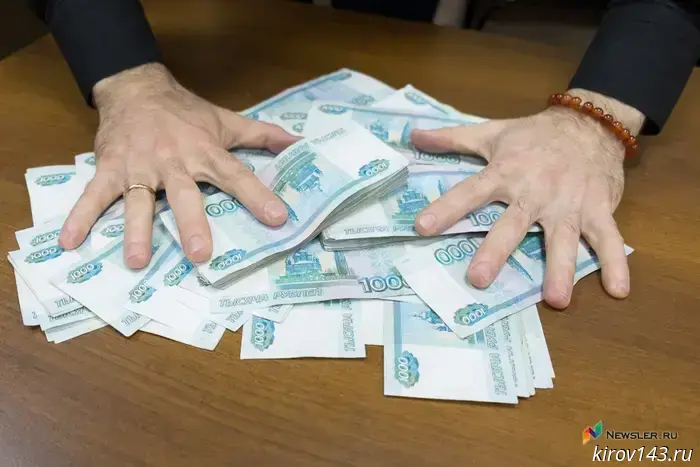

Kirov residents were reminded about the tax on interest earned from bank deposits

The tax authorities reminded residents of the Kirov region of the requirement to pay personal income tax on deposit income for 2024. The tax amount is calculated automatically and will be indicated in the tax notice, which will be issued in the fall. According to information from the regional tax authority, details of income from interest on bank deposits and savings accounts are already available in the taxpayer's personal account in the "Income" / "Interest on Deposits" section. The tax will be calculated based on data received from banks and reflected in the notice along with property taxes. Personal account users will receive an electronic notification at the beginning of autumn. Other citizens will receive the document by mail no later than 30 days before the deadline—by December 1, 2025. In 2024, 19,000 residents of the Kirov region will be required to pay a total tax of over 855 million rubles. It is reminded that only the part of the annual interest income exceeding the non-taxable minimum is subject to personal income tax. It is calculated using the formula: 1 million rubles multiplied by the maximum key rate of the Central Bank for the year. In 2024, the rate reached 21%, so the non-taxable income was 210,000 rubles. Citizens wishing to know their tax amount in advance are advised to use the services of their personal tax account.

Другие Новости Кирова (НЗК)

In Kirov, rules for the placement of electric scooters will be developed.

Today, the deputies discussed the preparation of changes to the rules governing the city's external appearance at the construction and beautification commission.

In Kirov, rules for the placement of electric scooters will be developed.

Today, the deputies discussed the preparation of changes to the rules governing the city's external appearance at the construction and beautification commission.

National Guard officers detained suspects in a fight at Kirov club

In Kirov, Rosgvardiya officers detained two young men who started a fight at a nightclub after a verbal conflict with other patrons.

National Guard officers detained suspects in a fight at Kirov club

In Kirov, Rosgvardiya officers detained two young men who started a fight at a nightclub after a verbal conflict with other patrons.

Almost 317 million rubles are planned to be allocated for the construction of an indoor ice rink in Kirov.

Funds will be allocated from the regional budget.

Almost 317 million rubles are planned to be allocated for the construction of an indoor ice rink in Kirov.

Funds will be allocated from the regional budget.

Violations found in a high-security colony in Verkhekame.

Acting Prosecutor of the Kirov Region, Dmitry Sherstnev, visited Correctional Colony No. 27 in Lesnoy. An inspection revealed violations in the provision of conditions of detention and in the educational work with convicts.

Violations found in a high-security colony in Verkhekame.

Acting Prosecutor of the Kirov Region, Dmitry Sherstnev, visited Correctional Colony No. 27 in Lesnoy. An inspection revealed violations in the provision of conditions of detention and in the educational work with convicts.

A resident of Kirov lost over 55,000 instead of receiving a birthday gift.

A man lost money after believing an advertisement about a discount from an online store. Reporting it to the police led to the initiation of a criminal case.

A resident of Kirov lost over 55,000 instead of receiving a birthday gift.

A man lost money after believing an advertisement about a discount from an online store. Reporting it to the police led to the initiation of a criminal case.

The growth index of utility payments in Kirov reached 15.5 percent, in Kirovo-Chepetsk — 16.9 percent.

At the legislative assembly committee meeting, the sharp increase in utility bills was discussed.

The growth index of utility payments in Kirov reached 15.5 percent, in Kirovo-Chepetsk — 16.9 percent.

At the legislative assembly committee meeting, the sharp increase in utility bills was discussed.

Kirov residents were reminded about the tax on interest earned from bank deposits

More than 19,000 residents of the region will pay over 855 million rubles to the budget.