Analyst: 90 percent chance of key rate decrease

On July 25, the RF Central Bank's Board of Directors will hold its next meeting, during which a decision on the key rate will be made. We contacted an analyst with the question of what to expect from this meeting. According to the expert, the key rate will most likely be decreased.

Natalia Milchackova, Lead Analyst at Freedom Finance Global:

"We believe that the Bank of Russia's Board of Directors will decide to reduce the key rate to 18% annually at the July 25 meeting, with a 90% probability of this outcome. There is a small 10% chance that the regulator will keep the key rate unchanged, but our baseline scenario is a rate cut.

In June, annual inflation, as estimated by Rosstat, slowed from 9.88% to 9.4%, and inflation expectations in July, as in the previous month, remain at only 13%, which provides strong arguments for lowering the key rate by two percentage points immediately. A strong ruble, which leads to lower prices for many imported goods, is also an important disinflationary factor. Another equally important disinflationary factor is the cooling of the credit market; lending in the first quarter of 2025 was nearly half the level of the same period in 2024. There are, of course, pro-inflationary factors as well, with the main one being the increase in utility tariffs starting July 1, which should begin to reflect in goods prices within 1-2 months. However, a sharp price jump is unlikely, as consumer prices have already risen sharply since the beginning of the year, and a demand collapse and possible oversupply are unprofitable for businesses.

Based on this, we believe that the RF Central Bank will make the most optimal decision on Friday, taking into account all inflationary and disinflationary factors — a rate cut of no more than two percentage points. It will be very interesting to see the updated inflation forecasts for this year and the interest rate corridor projections until the end of the year from the Bank of Russia on Friday. We expect that by the end of the year, the key rate could be reduced to 16-17% annually. This means that if the RF Central Bank cuts the ‘key’ rate to 18% on July 25, Russia could see at least two more rate cuts by the end of the second half of the year, one of which might occur as early as the next meeting of the regulator's Board of Directors in September."

Другие Новости Кирова (НЗК)

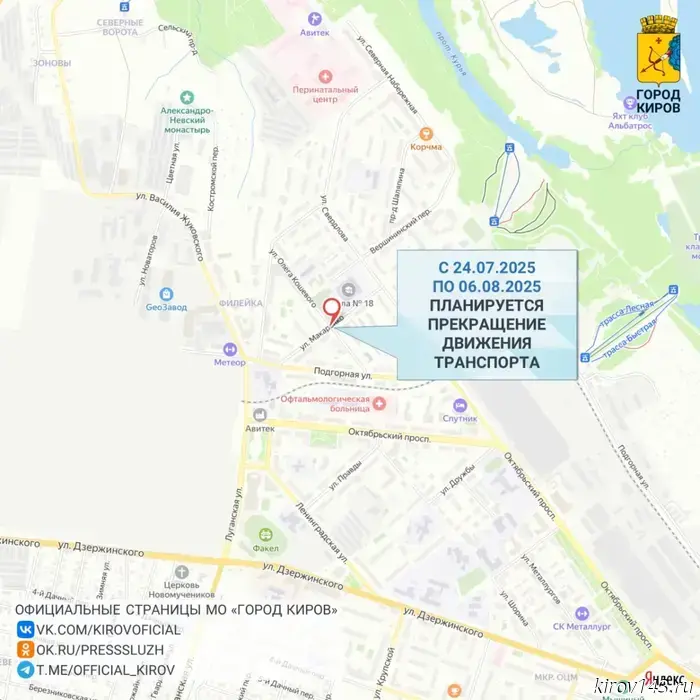

In Kirov, Oleg Koshevogo Street and Vozrozhdeniya Street will be temporarily closed.

The city administration announced maintenance work on the heating networks.

In Kirov, Oleg Koshevogo Street and Vozrozhdeniya Street will be temporarily closed.

The city administration announced maintenance work on the heating networks.

The sentence for Judge Ledensky will only hit his "pension pocket."

On June 25, the sentence issued by the Izhevsk Industrial District Court came into legal force regarding former Deputy Chairman of the Kirov Regional Court Igor Ledenskikh.

The sentence for Judge Ledensky will only hit his "pension pocket."

On June 25, the sentence issued by the Izhevsk Industrial District Court came into legal force regarding former Deputy Chairman of the Kirov Regional Court Igor Ledenskikh.

"Russian Post" suspected of pension embezzlement and extravagant PR.

The Accounting Chamber公布了对AO "Russian Post" activities audit results for 2020–2024 and the beginning of 2025.

"Russian Post" suspected of pension embezzlement and extravagant PR.

The Accounting Chamber公布了对AO "Russian Post" activities audit results for 2020–2024 and the beginning of 2025.

Love horoscope: Taurus should not rush things, and Capricorns will charm everyone.

Astrologers shared which events may happen in the personal lives of all zodiac signs this Wednesday.

Love horoscope: Taurus should not rush things, and Capricorns will charm everyone.

Astrologers shared which events may happen in the personal lives of all zodiac signs this Wednesday.

The highest-paid freelance professions have been named.

The average monthly income of freelancers in Russia in the first half of 2025 was 42,000 rubles, which is 31.2% higher than the figures for the same period in 2024.

The highest-paid freelance professions have been named.

The average monthly income of freelancers in Russia in the first half of 2025 was 42,000 rubles, which is 31.2% higher than the figures for the same period in 2024.

A man was convicted in Kirov for stealing a car using a tow truck.

A verdict has been issued in the Leninsky District of Kirov for a 24-year-old local resident accused of car theft.

A man was convicted in Kirov for stealing a car using a tow truck.

A verdict has been issued in the Leninsky District of Kirov for a 24-year-old local resident accused of car theft.

Analyst: 90 percent chance of key rate decrease

The expert explained what will happen to the key interest rate in the near future.