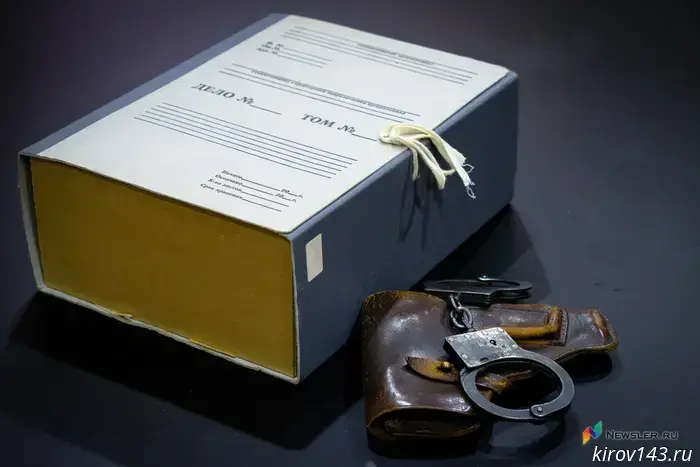

New law on criminal liability for droppers: what bank clients need to know

Who is a dropper?

A drop (or dropper) is a person who, either voluntarily or unknowingly, participates in financial schemes by providing their account, card, or details for conducting various operations.

In most cases, droppers are offered a small reward for their services, such as issuing a card, receiving and forwarding money, providing access to online banking, etc. However, sometimes, individuals who consider these actions harmless may not even realize their involvement in unlawful activities.

There are several types of droppers. The main categories include:

Cash handlers — receive money and cash it out.

Transit participants — accept transfers and send them to other participants.

Depositors — deposit cash into accounts and pass it further.

Regardless of the specific role a dropper plays, all of this forms part of the money laundering chain involving illegally obtained funds: from thefts from citizens' accounts to income from illegal businesses.

Who is at risk?

Anyone can become a victim of fraud, but scammers most often involve teenagers, students, pensioners, and other people lacking sufficient financial literacy.

Common methods of involvement in criminal activity include:

- Announcements about "quick earnings" in messengers and social networks;

- Offers to open a card and pass it for a reward;

- "Accidental transfers" from strangers with requests to return the money;

- Requests to "help at an ATM" or to provide card details during an "interview."

Participation in such activities constitutes a violation of Article 187 of the Criminal Code of Russia, which penalizes unlawful circulation of payment funds. Penalties depend on the role in the scheme and the level of awareness: the maximum punishment can include a fine of up to 1 million rubles and/or imprisonment for up to 7 years.

Additionally, a dropper may be blacklisted by banks and held civilly liable, including being required to compensate for all damages caused to victims by scammers.

How not to become a dropper?

To avoid accidental involvement in criminal activities with serious legal consequences, follow basic financial security rules:

- Do not share your cards, login details, passwords, or personal information with strangers.

- Be cautious of suspicious offers of quick and easy earnings.

- Do not transfer money to strangers, especially if asked to forward funds with promises of a reward.

- Regularly monitor your account activity and immediately report suspicious transactions to your bank.

- Ensure the financial safety of your children and elderly relatives—regularly discuss potential risks and explain how to act correctly in different situations.

Remember, your attentiveness and awareness are your main tools for protecting and maintaining financial security. By being cautious and responding promptly to potential threats, you can safeguard yourself and your loved ones from involvement in illegal activities and their negative consequences.

Другие Новости Кирова (НЗК)

Two flights from Kirov are delayed.

The flight to Sochi was delayed by nearly three hours, to Moscow — by 10 minutes.

Two flights from Kirov are delayed.

The flight to Sochi was delayed by nearly three hours, to Moscow — by 10 minutes.

A special fire safety regime has been introduced in two municipalities.

Large fines now threaten those who light fires and commit other violations.

A special fire safety regime has been introduced in two municipalities.

Large fines now threaten those who light fires and commit other violations.

The Federation Council approved fines for searching extremist materials and using VPNs.

The Federation Council approved a law that imposes fines of up to 5,000 rubles for deliberate search of extremist materials on the internet. The document also provides for substantial sanctions for advertising and distributing VPN services. The Federation Council acknowledges that there are indeed risks of abuse in applying the new norms.

The Federation Council approved fines for searching extremist materials and using VPNs.

The Federation Council approved a law that imposes fines of up to 5,000 rubles for deliberate search of extremist materials on the internet. The document also provides for substantial sanctions for advertising and distributing VPN services. The Federation Council acknowledges that there are indeed risks of abuse in applying the new norms.

Over a thousand foreigners in the Kirov region are registered as controlled persons.

Since the beginning of February, Russia has implemented a deportation regime for foreigners who violate immigration laws. In the Kirov region, 1,025 individuals have already been included in the registry of monitored persons.

Over a thousand foreigners in the Kirov region are registered as controlled persons.

Since the beginning of February, Russia has implemented a deportation regime for foreigners who violate immigration laws. In the Kirov region, 1,025 individuals have already been included in the registry of monitored persons.

Oleg Valenchuk: The road program is changing the lives of Vyatka gardeners

The Union of Gardeners of Russia continues work on grading the roads to the gardening associations on Pobedilovsky Tract.

Oleg Valenchuk: The road program is changing the lives of Vyatka gardeners

The Union of Gardeners of Russia continues work on grading the roads to the gardening associations on Pobedilovsky Tract.

A woman from Kirov transferred 1.35 million to scammers after believing the story about transferring money for the Ukrainian Armed Forces.

A resident of Kirov became a victim of online fraud: unknown individuals, posing as FSB and Central Bank employees, convinced her that her savings were being attempted to be stolen and redirected to the accounts of the Ukrainian armed forces. To "save" her money, the woman transferred 1.35 million rubles to them.

A woman from Kirov transferred 1.35 million to scammers after believing the story about transferring money for the Ukrainian Armed Forces.

A resident of Kirov became a victim of online fraud: unknown individuals, posing as FSB and Central Bank employees, convinced her that her savings were being attempted to be stolen and redirected to the accounts of the Ukrainian armed forces. To "save" her money, the woman transferred 1.35 million rubles to them.

New law on criminal liability for droppers: what bank clients need to know

From July 5, 2025, in Russia, amendments to the criminal legislation came into force, establishing responsibility for participation in illegal operations involving bank cards and payment instruments. Particular attention is given to so-called droppers—straw persons through whom fraudsters transfer money obtained via criminal means. A detailed explanation of this type of fraud was provided by Andrey Popov, head of the bank Khlynov's information security department.