Residents of the region can receive a tax deduction of up to 18 thousand rubles.

Residents of the Kirov region can receive a tax deduction of up to 18 thousand rubles if they pass the TRP standards and receive a badge of distinction. You can apply for it through your employer for the year in which the standards were passed.

It is important that a person undergo a medical examination in the same year. Only if this condition is met will the deduction be approved. It aims to promote a healthy lifestyle and regular exercise.

In addition, there is a social deduction for sports and recreation services. It can be obtained by both adults and parents for minor children. Expenses for fitness centers, swimming pools and sports sections are subject to compensation.

The maximum amount of such deduction is 150 thousand rubles per year. The current list of organizations whose services are subject to deduction is posted on the website of the Ministry of Sports of Russia.

Другие Новости Кирова (НЗК)

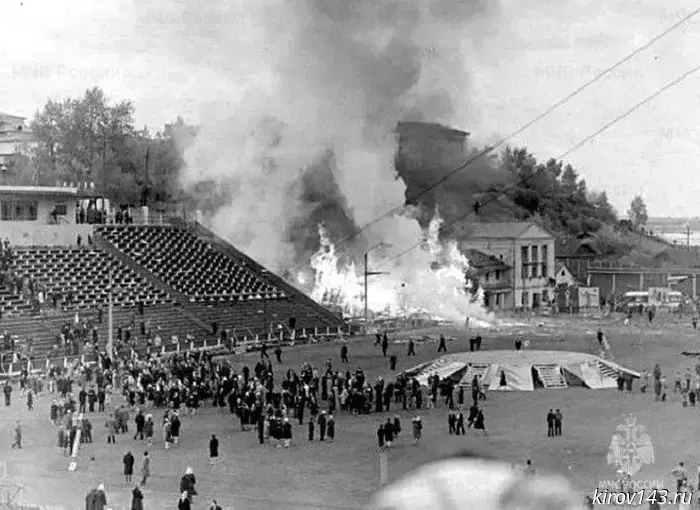

The Ministry of Emergency Situations told about the tragedy at the Kirov stadium "Labor Reserves"

According to the Ministry of Emergency Situations of the Kirov region, for decades the topic of the explosion on the "Labor Reserves" was classified as "secret".

The Ministry of Emergency Situations told about the tragedy at the Kirov stadium "Labor Reserves"

According to the Ministry of Emergency Situations of the Kirov region, for decades the topic of the explosion on the "Labor Reserves" was classified as "secret".

The sidewalk collapsed in the Forest and the road cracked

Kirov residents reported the washing of the site on Lesnaya Street, which destroyed the pedestrian zone.

The sidewalk collapsed in the Forest and the road cracked

Kirov residents reported the washing of the site on Lesnaya Street, which destroyed the pedestrian zone.

Kirov residents were warned about new fraud schemes

To deceive Kirov residents, fraudsters began to use the Unified State Exam and vacation offers.

Kirov residents were warned about new fraud schemes

To deceive Kirov residents, fraudsters began to use the Unified State Exam and vacation offers.

More than 38 thousand residents of the region underwent reproductive medical examination

The examination helps to prepare for the birth of children.

More than 38 thousand residents of the region underwent reproductive medical examination

The examination helps to prepare for the birth of children.

Kirov region ranks 58th in terms of family welfare

RIA Novosti has compiled a rating of Russian regions on family well-being in 2024.

Kirov region ranks 58th in terms of family welfare

RIA Novosti has compiled a rating of Russian regions on family well-being in 2024.

Kirov fraudster received three years of "strogach"

A member of a criminal group was sentenced in Kirov.

Kirov fraudster received three years of "strogach"

A member of a criminal group was sentenced in Kirov.

Residents of the region can receive a tax deduction of up to 18 thousand rubles.

The government told us who can count on a tax deduction.