More than six thousand Kirov residents applied for deductions in a simplified manner

The Office of the Federal Tax Service for the Kirov region reminded residents of the region of the right to receive tax deductions in a simplified manner. This form allows you to return part of the taxes without visiting the tax inspectorate and without submitting a declaration on the 3-personal income tax form.

Currently, investment, property (including mortgage interest), and social tax deductions can be simplified, such as for tuition, medical treatment, or voluntary insurance.

Starting from January 1, 2025, the list will be supplemented by deductions for long-term savings provided for by Federal Law No. 58-FZ. This applies to contributions under contracts with non-governmental pension funds and transactions on individual investment accounts opened since 2024.

To take advantage of this opportunity, you must:

be a user of the Taxpayer's Personal Account service on the FTS website

and have income from which personal income tax

has been paid so that the organization or institution transmits information about expenses to the tax authority.

After receiving the information, the tax service forms a pre-filled application and sends it to the taxpayer's personal account. The citizen only needs to specify the bank account number and confirm the shipment.

Since the beginning of 2025, 6,367 residents of the Kirov region have already taken advantage of this opportunity.

Другие Новости Кирова (НЗК)

The administration of the Murashinsky district illegally charged a pensioner for social housing

The prosecutor's office helped the elderly resident to achieve justice.

The administration of the Murashinsky district illegally charged a pensioner for social housing

The prosecutor's office helped the elderly resident to achieve justice.

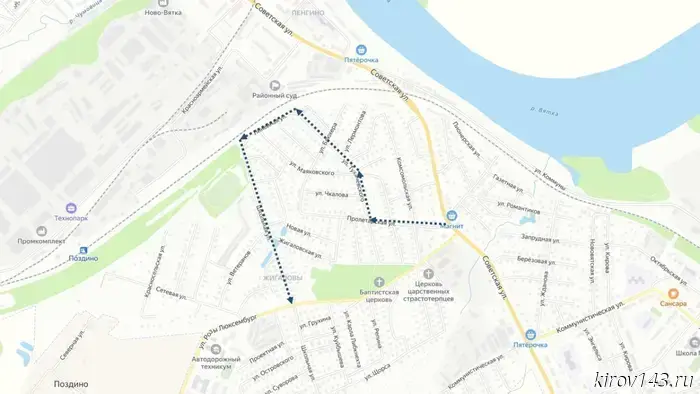

In Novovyatsk, due to the closure of the crossing, one-way traffic will be introduced on several streets.

Public transport will be allowed through these sections during the construction of the tunnel.

In Novovyatsk, due to the closure of the crossing, one-way traffic will be introduced on several streets.

Public transport will be allowed through these sections during the construction of the tunnel.

The Russian mandate was given to Levanov

The decision to transfer the deputy's mandate was made at a meeting of the Election Commission of the Kirov region.

The Russian mandate was given to Levanov

The decision to transfer the deputy's mandate was made at a meeting of the Election Commission of the Kirov region.

April cold: How to protect your health when spring plays into winter

Spring brings surprises this year: a sharp cold snap in April, when the body has already managed to get used to the heat, threatens not only to spoil the mood, but also to undermine the immune system. General practitioner Evgenia Gorbacheva told Life.ru how to survive temperature swings without harming your health.

April cold: How to protect your health when spring plays into winter

Spring brings surprises this year: a sharp cold snap in April, when the body has already managed to get used to the heat, threatens not only to spoil the mood, but also to undermine the immune system. General practitioner Evgenia Gorbacheva told Life.ru how to survive temperature swings without harming your health.

The regional government includes a veterinarian

The Governor of the Kirov region has approved the new composition of the regional government.

The regional government includes a veterinarian

The Governor of the Kirov region has approved the new composition of the regional government.

In Kirov, a 19-year—old driver was convicted of repeated drunk driving - the car was confiscated.

A young Kirov resident was found guilty of driving under the influence of alcohol, despite the fact that he had previously been held accountable for a similar violation. The court ordered him to perform compulsory labor and deprived him of his driver's license, and the car was transferred to state ownership.

In Kirov, a 19-year—old driver was convicted of repeated drunk driving - the car was confiscated.

A young Kirov resident was found guilty of driving under the influence of alcohol, despite the fact that he had previously been held accountable for a similar violation. The court ordered him to perform compulsory labor and deprived him of his driver's license, and the car was transferred to state ownership.

More than six thousand Kirov residents applied for deductions in a simplified manner

The Federal Tax Service for the Kirov region reminded residents of the region about the possibility of receiving tax deductions in a simplified manner — without filling out the 3-personal income tax and a personal visit to the inspectorate.